Battery storage systems are an essential component of the energy sector. However, they are complex systems that require special attention. The primary goal of storage owners is to maximize the profit possible from the storage system without taking on additional risk. This is where battery analytics comes into play.

Energy Storage Analytics

Battery analytics: The game changer for energy storage

More than 25 GWh of stationary battery storage is already installed worldwide. This will rapidly increase, as battery storages are ideally suited to address the challenges of the energy transition. Unlike most other power plant technologies, batteries can not only supply energy, but also store it. And they do so within milliseconds. This makes them suitable for numerous use cases, both front-of-the-meter and behind-the-meter. In addition, falling battery prices make investments more attractive. Combined, these factors fuel a boom in battery storages that is estimated to reach an installed capacity of 900 GWh by 2030 (BNEF).

Many of the market actors – system integrators, asset owners, but also partners and financial service providers – identify the main reasons for a decision not to move forward with a battery project as technical risks in conjunction with market challenges and a changing regulatory environment. Market risks involve fluctuating prices, while new regulations can destroy a business case (or sometimes also sending it through the roof). One example of a bullet-proof business case is California. Here, market risk was all but eliminated by the revenue of most projects being protected by long term power purchase agreements (PPAs). Consequently, projects with hundreds of MWh are no longer rare. Every change – positive or negative – but also any battery storage project in general, requires careful assessment of the impact use will have on the battery.

Challenging technical risks

Batteries are complex electro-chemical systems and come with some technical challenges. As a new asset class, many players that have never dealt with batteries before now find that they are essential to their success. To ensure a common understanding, let’s establish a few facts:

- Battery storages are generally a very safe and reliable technology. However, like any other technical system, battery cells or other components can fail. The consequences depend on the severity and the reaction. Best case, moderate reduction in performance or unplanned maintenance. Worst case, if the issues are not immediately addressed or an essential component fails without warning: unplanned downtime with major repairs. One eye-catching example is battery storage fires, e.g. in Korea and Arizona (2018 and 2019, respectively) which attracted a lot of media attention. The probability is less than 1:1,000,000 but if it happens, it is large scale disaster.

- Downtimes are a technical risk that translates directly into a financial risk. While downtime may not seem dramatic at first glance, certain use cases depend on the availability of a battery. When energy is not available when required, penalties due to breach of contract are incurred or, more simply: a very high bill. Energy solutions that include battery storages can save up to 90% of a company’s electricity bill (EM-Power Europe 2021) – if the storage fails during peak time there are no savings for that year (and the company still pays for the storage).

- At an advanced stage of the battery lifetime, there is the risk that power or capacity requirements are not met anymore. This results in the exclusion of certain markets and use cases, but also contains the risk of unexpected penalties.

Existing warranties can only partially address these challenges or become prohibitively expensive, as it is impossible for the insurer to assess the risk. In short, batteries come with great opportunities but also high, yet manageable risks. Let’s take a look at battery analytics to understand why.

Battery aging and analytics

Battery analytics refers to getting more out of the battery using software – not only during operation, but also when selecting the right battery cell or designing the overall system. For now, the focus will be on the possibilities to optimize the in-field operation of battery storages.

Why is battery analytics so important?

Battery degradation, also called aging, has a significant impact on performance over the lifetime. In time, two major effects become visible: capacity fade and resistance increase, translating to less available energy and power. The overall capabilities are often collectively measured in a KPI called state of health (SoH). This aging behavior and state of health is driven by numerous factors and can vary greatly from one battery system to another. Two batteries with 90% SoH may have wildly different remaining useful lifetimes, depending on their previous treatment. Let’s look at some of these factors:

- Temperature: This has a large impact but depending on the situation and cell (chemistry) different temperature ranges can be beneficial. As a rule of thumb: When the battery is idle, low temperatures are preventing too much calendric aging (i.e., aging that occurs with time without usage) while moderately warm temperatures (e.g. 30°C) may be the best option for strong cycling.

- C-rate: Different battery types are used for different use cases. In general, high c-rates tend to have a greater impact on aging than low c-rates.

- (Average) state of charge (SoC): While it is desirable to have a lot of energy available (depending on the use case), higher average SoCs may accelerate the aging. Too low SoCs may threaten the business case, as not enough energy is available. Too low SoCs should always be technically prevented by the battery management system to prevent damage).

- Depth of Discharge (DoD): This refers to the amount of energy that is taken out of the storage at any given time. In a battery discharging from 80% to 35% SoC this translates into a DoD of 45%. As a rule, lower DoDs are beneficial with five swings of 20% being less harmful than one full cycle. Thus, 10 cycles in an arbitrage operation will have a larger impact on battery degradation than 10 cycles in ancillary services.

The reality is more complicated. Every battery type reacts very differently to each of these stress factors. And if – to prevent battery degradation – the battery is operated too carefully regarding the described stress factors, a lot of potential is wasted.

So why not simply put a lot more capacity into the storage (called oversizing or over stacking) from the beginning? Firstly, because the initial investment costs will skyrocket and ruin your business case. Most users will aim to leverage as much of the storage as possible. Which leads to the second point: While a couple of years ago, the optimization for a specific use case upfront may have been a valid idea, use cases have since become more complex. Multi-use strategies, or a change of operating strategy after a while, will become mandatory for high profitability. As a result, dimensioning the system at the outset has become less important and dispatch planning is happening regularly, requiring new insights into the current battery capabilities and the impact of different operating strategies.

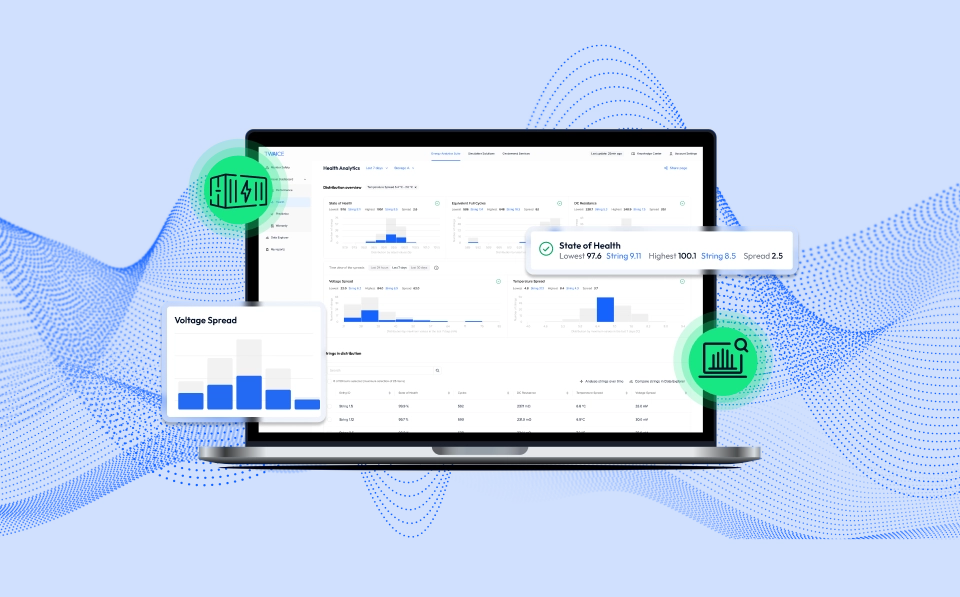

The TWAICE cloud analytics platform provides insights and solutions based on field data. The differentiation factor is the end-to-end approach with analytics at its heart. After processing and mapping the data, the platform analytics layer runs different analytical algorithms, electrical, thermal and aging models as well as machine learning models. This variety of analytical approaches is the key to balance data input quality differences and is also the basis for the wide and expanding range of solutions.

Reducing the levelized costs of storage with battery analytics

Anyone purchasing a battery system wants guaranteed performance. It is therefore essential that manufacturers and integrators of such systems offer the best possible warranty. Tracking and simulating the impact of the usage on performance and corresponding warranty is the key to unlocking this potential.

Integrators face the challenge of combining multiple supplier warranties into a system warranty for their customers. This also includes several performance warranties ranging from capacity performance to availability performance, and often even includes a warranty on roundtrip efficiencies. To have an overview on their performance warranties, integrators need to collect data, perform (manual) analyses and communicate the performance and the warranty status to their clients. In the event of a warranty claim, the agreed conditions must be restored and the claim forwarded to the cell supplier. The complexity increases with the variety of ingoing and outgoing warranties – it is the norm rather than the exception and there are no standard contracts.

In addition to the strategic considerations, let’s not forget the operational benefits of a monitoring tool enhanced by analytics. Operation and maintenance teams benefit from a more precise data analysis in real time, e. g. faulty modules or modules that have experienced aging can be identified and replaced by the service team.

There is yet another challenge that can be solved. Today, it is difficult for integrators to renegotiate the warranty terms in the case of a new operating strategy because of the unknown impact on performance. The required transparency and predictability can be provided by predictive battery analytics simulating the impact on system performance as well as on the warranty terms.

Low profitability and long amortization periods are two of the main challenges that owners face when planning and operating their battery storage projects. Energy prices are fluctuating, unpredictable and the regulatory environment differs internationally and even within the same country. For example, the German primary frequency response (PFR) market has experienced a significant price drop over the past few years. To restore profitability, many asset owners are considering adapting their operating strategy or working on a multi-use operating strategy. However, the complex aging behavior of batteries makes the optimization and selection of the most profitable strategy difficult. A continuous use of battery analytics can generate value for the customer in a wide variety of ways:

- Considering battery aging when planning operating strategies helps the owner to better decide between different strategies. This way, the optimal operating strategy can be selected to balance the expected revenue and battery lifetime to increase the overall return of investment – before and during operation.

- When commercially operating a storage, an estimation of the true costs of aging per cycle and energy can be incorporated into the market optimization software and price planning – daily or even more frequently if needed. This enhances the profitability.

- Also, the owner will know that the storage can be used throughout the planned duration for the selected strategy. The risk of a premature storage underperformance is minimized as counter-measures can be taken preventively.

Giving batteries a retirement home – analytics driving 2nd life applications

2nd life usage of batteries is a controversial topic. Some experts argue that the costs for repurposing are too high and batteries should be purpose-built to reach their full potential. Consequently, they do not believe in the economic feasibility or plausibility of 2nd life applications and favor recycling instead of repurposing.

Other experts contend the issue of used batteries being recycled while still in good condition and able to add great value in other applications.

The challenge will always be to efficiently select the batteries that are still suitable for 2nd life applications. An economic and ecological assessment with regard to potential benefits from a second life compared to the alternative must take place. The key here is an efficient assessment of the battery health as well as the performance that can be expected in the 2nd life application – battery analytics based on already existing data is the solution.

Looking at the economic aspects: High repurposing costs combined with the reduced bankability of most 2nd life batteries means there is currently little incentive to purchase a used battery. However, repurposing costs are falling, and the other issues can be solved as well – both due to battery analytics.

- The battery status can be determined based on historic data, and repurposing costs, which largely consist of bench testing and the associated logistics costs of shipping batteries from A (1st life operation) to B (testing facility) to C (assembly of 2nd life storage) can be minimized. The historic battery data can be used to provide a precise SoH and consequently physical testing can be avoided and repurposing costs are reduced significantly.

- All of the regular optimizations of energy storage that were discussed before also apply for 2nd life batteries. Including battery analytics, potentially in combination with an extended warranty, can increase the bankability of projects including 2nd life batteries.

Battery analytics to provide services jointly with 3rd parties

As a neutral authority and provider of predictive battery analytics, TWAICE creates trust and builds the basis for partnerships, e. g., with Munich RE on insurance services and with TÜV on residual value determinations and certifications.

Battery analytics are the essential differentiator

There is a lot of untapped potential. In a market with increasing volumes, decreasing prices and an increasing consolidation – not surprisingly, this had led to strong competition and there are still many new players trying to gain a foothold in this dynamically growing and evolving market. Competitive pricing has become a necessary requirement to exist in a market with both powerful suppliers (battery and PCS manufacturers) and powerful clients (utilities and IPPs with ever increasing pipelines). Of course, integrators will seek to differentiate with innovative products and additional solutions – and will try to become more vertically integrated.

The top seven players of 2021 accounting for around two thirds of the integrated capacity in 2021 (compared to around 30% between 2016 and 2019) is a clear indication of an ongoing market consolidation (BNEF: Energy Storage System Providers 2021). Nevertheless, due the dynamic growth described here, new players keep trying to establish themselves in the market to get their piece of the pie. To secure their position, the established businesses are expanding their product portfolios. While a couple of years ago the physical system integration was their focus, most people – in addition to offering energy management system (EMS) software which has become almost a market standard – provide battery management system (BMS) software, and some even offer energy trading software. Also, O&M services and EPC (Engineering, Procurement, Construction) now belong to the standard portfolio. This is necessary, as these players are being squeezed by the suppliers, not only with respect to pricing and minimum purchase quantities, but also because of the suppliers’ ambitions to increase their upstream activities. Additionally, there is also downstream integration by solar and battery project developers enhancing their system integration capabilities to source directly from component suppliers, i.e., to skip the middlemen.

Battery analytics is increasingly recognized as the key to more market traction and higher profitability. Improving transparency into the projects for which they still have ongoing warranty obligations or to driving the service offering towards the storage owners and operators enables users to differentiate from competition.

Finally, a word from the software provider’s perspective: it is far easier – and cheaper for the customer - to connect to the storage and influence the data quality in an early project phase than retrofitting the solution to an existing project set-up.

Need more information? Let's talk

See TWAICE Energy Storage Analytics in Action

Sign up for the next live group demo and learn how TWAICE can transform your BESS operations. In just 30 minutes, you’ll get a demo of key features and use cases, and engage with our product experts for a live Q&A.

.avif)